The escalating perpetual debt crisis among Americans is not just a financial hurdle—it’s a form of modern-day enslavement, a barrier that keeps many from ever making progress. The cycle of high-interest debt is a formidable obstacle to economic freedom and prosperity.

Let’s consider the high cost of credit card debt in a scenario where an individual carries a $50,000 balance on a credit card with interest rates varying around 20% and makes nearly the minimum payments, approximately $850.00. In such cases, a consumer might end up paying over $152,000 in interest alone, on top of the original $50,000 debt, and now assuming no further use of the credit card, which could otherwise escalate the total debt even further. Note that the duration would be 238 Months, as shown from an online Credit card Payment Calculator.

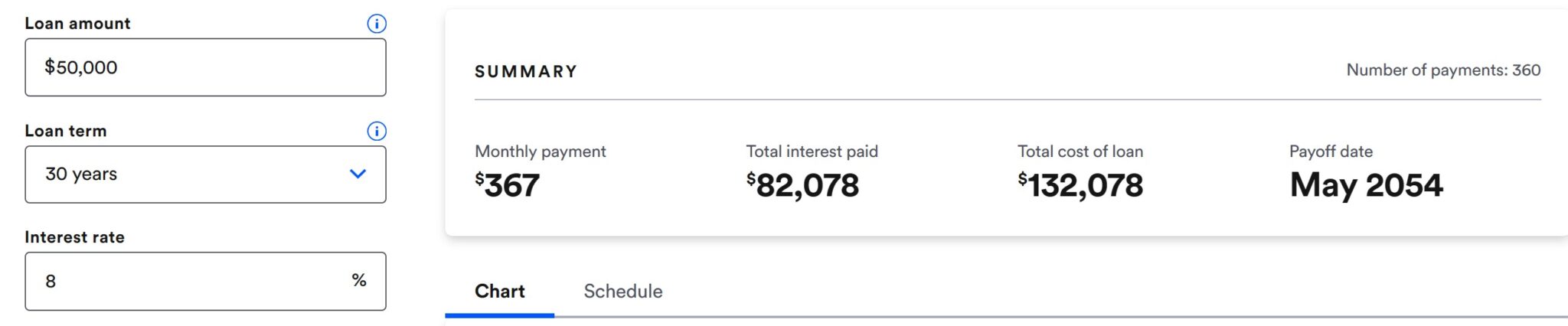

A Ray of Hope: Second Mortgages in the face of these staggering figures, there’s a potential lifeline that could come from government interventions allowing homeowners to secure second mortgages. This option could offer a path to consolidate high-interest debt into a secured, lower-interest loan with a longer repayment term. For example, transferring $50,000 of credit card debt to a second mortgage at an 8% interest rate spread over 30 years would result in total interest payments of approximately $82,078, making the overall expense around $132,078. While this is still a significant commitment, it’s a far cry from the potential credit card scenario.

The Broader Economic Implications and its effect on the housing markets could have long-term implications. Consumer and Corporation debt can exacerbate economic disparities and limit economic growth, as individuals or entities cannot invest in their futures or spend on goods and services.

We might see additional opportunities in the secondary real estate market by Freddie Mac later this year, and doing so could help some lower credit card debt. However, it could further burn the Real Estate market unless the perpetual original debt trap is averted.

This is not financial or legal advice, please see your trusted professionals and use for general knowledge.

References

FHFA: https://www.fhfa.gov/SupervisionRegulation/Rules/Pages/Freddie-Mac-Proposed-Purchase-of-Single-Family-Closed-End-Second-Mortgages-Comment-Request.aspx

Bankrate Credit Card: https://www.bankrate.com/finance/credit-cards/credit-card-payoff-calculator/

Bankrate Mortgage: https://www.bankrate.com/mortgages/amortization-calculator/

Artwork: Primary Images Dall-E AI,

#FHFA #GSE #2nd #Seconds #loans #FreddieMac #Finance #Debt #CreditCard #Mortgage